Introduction

Imagine you’re sitting in a café, coffee in hand, scrolling through news about the stock market, and thinking: “If only I had thousands to invest, then I could really play the game.” What if I told you you don’t need thousands — you can start with $100, $500, or $1,000, and build something meaningful? In this post I’ll walk you through how to begin investing in the stock market at three different levels, drawing on research, real-world insight, and one or two of my own experiences. The aim: clarity, confidence and momentum.

Comparison: What can you do with $100, $500 or $1,000?

Let’s begin by comparing how the starting amount changes your options. Think of this as three “tiers” of entry.

Tier Table

| Starting Amount | What’s possible | Key advantages & limitations |

|---|---|---|

| $100 | Buy fractional shares of one or two stocks or ETFs, open a brokerage account, start simple. Robinhood+2NerdWallet+2 | Advantage: low barrier to entry, you build the habit. Limitation: diversification is constrained; each cost/fee carries heavier weight. |

| $500 | Enough to buy a small diversified basket (via e.g. low-cost ETF + one individual stock), start practicing asset allocation. Investopedia+1 | Advantage: slightly more flexibility and meaningful size. Limitation: still not huge, margin for error is thin. |

| $1,000 | Much more meaningful: can build a modest portfolio, split across a few stocks or ETFs, maybe begin a “core” and a “satellite” strategy. Schwab Brokerage | Advantage: enables more diversification, and you can begin to think more strategically. Limitation: must still manage risk and avoid overtrading. |

My personal anecdote

When I first dipped my toes into the stock market, I started with about $300 (adjusting for inflation). I used a brokerage that offered fractional shares. My first trade: I bought a slice of a well-known tech company, and I also bought a broad ETF. I remember the awkwardness of worrying whether the $300 was “worth it” — but the act of investing and watching it grow (or sometimes shrink) taught me far more than the size of the amount. The lesson: starting matters more than “how big.”

Key Insights & Strategies for Starting in the Stock Market

Whether you’re starting with $100, $500 or $1,000, there are universal strategies that will serve you.

1. Clarify why you’re investing

Before worrying about tickers, ask: What is this money for? A long-term goal (retirement in 20+ years)? Or a 5-year goal? Fidelity+1

Your time horizon will shape how much risk is appropriate. If you’re investing $500 and planning to withdraw in 2 years, you’ll want more conservative choices than someone investing $500 for retirement 30 years away.

2. Choose the right account/vehicle

Open a brokerage or investment account that is fee-friendly, allows fractional shares (important if you’re starting small), and has a platform you understand. Many brokers now offer zero-commission trading and fractional shares. Schwab Brokerage+1

Also think: Is this taxable, or is there a tax-advantaged account in your country? (Though in some jurisdictions you may just start with a standard account.)

3. Leverage fractional shares and low minimums

This is especially relevant for starting small. Many brokers allow you to buy a fraction of a share for e.g. $5 or $10 rather than needing to buy a whole share that costs $500+. Schwab Brokerage+1

That means you can access high-priced stocks even with modest capital, which opens up opportunities.

4. Diversify — even with modest sums

Diversification doesn’t mean you need 50 stocks. It means you spread your money so you’re not depending on a single bet. With smaller amounts, that might mean choosing a broad ETF plus maybe one individual stock. Encyclopedia Britannica+1

For example, if you invest $1,000 you might put $700 into a market-index ETF and $300 into one or two companies you like. With $100 you might do $70 / $30 split.

5. Automate and use dollar-cost averaging (DCA)

Rather than trying to time the market, set up a regular interval of investing (e.g., monthly) so you buy in regardless of market ups or downs. That spreads risk and lowers the pressure of “when do I buy?” Wikipedia+1

For example: If you start with $100 now, then add $50 each month, over time you build both habit and size.

6. Understand and manage fees & costs

With small amounts especially, high fees can consume your returns. Choose brokers with low or zero commissions. Also be aware of expense ratios if you’re using funds/ETFs. Encyclopedia Britannica+1

For instance, if you pay $10 in fees on a $100 investment, that’s huge relative cost. So pick wisely.

7. Have a mindset for long-term growth and learning

Starting with $100 might feel trivial, but it’s a learning opportunity. You’re building investing muscle: choosing what to buy, seeing how markets behave, controlling emotions. My experience: making small mistakes early (and learning from them) is far cheaper than making big mistakes later with tens of thousands.

Rather than chasing “hot picks,” aim to grow your knowledge, refine your process, and keep investing.

8. Set realistic expectations

The stock market is volatile. Returns aren’t guaranteed. Especially when you start small, it’s about growth over time, not overnight fortune. Some investors on forums say:

“$75 and never investing again is unlikely to ever be anything meaningful not 10 years not 40 years…” Reddit

So start small, commit to add regularly, and maintain patience.

Strategy Breakdown by Starting Amount

Let’s get practical and tailor strategy slightly depending on the starting amount.

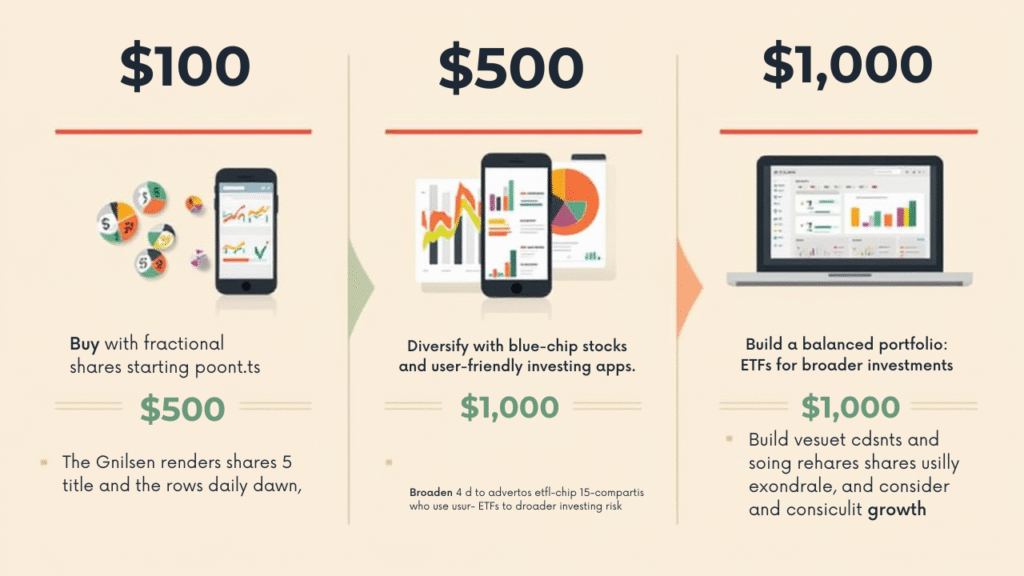

Starting with $100

- Open a brokerage that allows fractional shares and minimum deposit ≤ $100.

- Choose perhaps one broad ETF (e.g., US large-cap index) for ~$50, and one individual stock you believe in for ~$50.

- Set up monthly auto-transfer of e.g. $25.

- Accept that your portfolio’s size is small — your goal is habit and learning.

- Avoid over-trading — every trade should be purposeful, not impulsive.

Starting with $500

- Good base to do: ~70% into an ETF (e.g., global stock index) and ~30% into 2-3 individual stocks (≈ $150 total).

- Consider splitting across sectors (e.g., one tech, one consumer) or one domestic and one international.

- You might set up auto-invest $50 a month.

- Track your portfolio (you can use a simple spreadsheet) to see how the pieces behave for you.

Starting with $1,000

- You now have meaningful enough capital to treat this almost as a “real” portfolio.

- Example allocation: $600 into core ETF, $400 into individual stocks (maybe split into 3 stocks ~$130 each).

- Think about risk: with $1,000 you can afford a bit more complexity but shouldn’t over-complicate.

- Revisit your portfolio semi-annually: Are you still comfortable with your risk? Are the stocks still ones you believe in?

- Consider setting aside time each quarterly to read a financial-news piece, review an annual report. The habit of review becomes valuable.

Common Pitfalls & How to Avoid Them

- Waiting for “the perfect time” to invest. Many delay because they think they need a lot of money or need to wait for the market to “go down.” The data show: starting earlier typically beats waiting. Schwab Brokerage

- Not having an emergency fund first. If you invest money you might need in the short term, you risk needing to pull out in a downturn. As one forum user said: “If you have very little money, you’d be best served keeping it in something essentially risk-free … until you’ve got ~6 months of expenses built up.” Reddit

- High costs eating small portfolios. If fees or minimums are high, they disproportionately bite smaller portfolios. Choose low-fee platforms.

- Over-trading / chasing hot stocks. Especially with smaller amounts, flip-trading eats fees and taxes and distraction.

- Neglecting learning. Even with $100, treat this as educational. Read up, stay curious, refine your strategy.

Why This Works in the Current Era

The good news: compared to decades ago, the hurdles to entering the stock market are much lower.

- Fractional shares mean you don’t need to buy a whole share costing hundreds or thousands. Robinhood+1

- Many platforms now offer zero‐commission trades.

- Low-cost index funds and ETFs mean you can get diversification at low cost. Encyclopedia Britannica

- Investment apps and automations make regular investing easy. Wealthsimple

All of this means if you begin with $100, $500 or $1,000, you’re not at a structural disadvantage compared to “large” investors—if you act wisely.

Conclusion & Call-to-Action

Starting to invest in the stock market doesn’t require a luxury budget. Whether you have $100, $500 or $1,000 — the key is to begin, build consistency, learn as you go, and keep your focus on long-term growth rather than quick wins. Remember: it’s not how much you start with, it’s that you start.

👉 Your next step: Choose your starting tier ($100 / $500 / $1k). Open a brokerage account if you haven’t. Decide your split (core ETF + individual stocks). Set up an auto-transfer. Make one purchase this week.

I’d love to hear: What starting amount are you comfortable with? What portfolio split feels right for you? Share your thoughts below, and if you found this useful, subscribe for more posts on investing, growth mindset and the stock market. Let’s grow together.