Stock Market Basics: A Complete Guide for Beginners

Introduction

If you’ve ever watched stock prices scroll across the bottom of a news channel and thought, “I wish I understood how this all works,” you’re not alone. The stock market can seem mysterious, complicated, or even intimidating from the outside. But in reality, it’s simply a system where everyday people can become part-owners of businesses that shape the world.

Whether you dream of financial independence, want to beat inflation, or just hope to grow your savings faster than a traditional bank account, understanding how the stock market works is your first step. This guide will walk you through the basics in a clear, relatable way — from what stocks really are to how you can start investing even as a complete beginner.

What Is the Stock Market and Why It Matters

How It Works

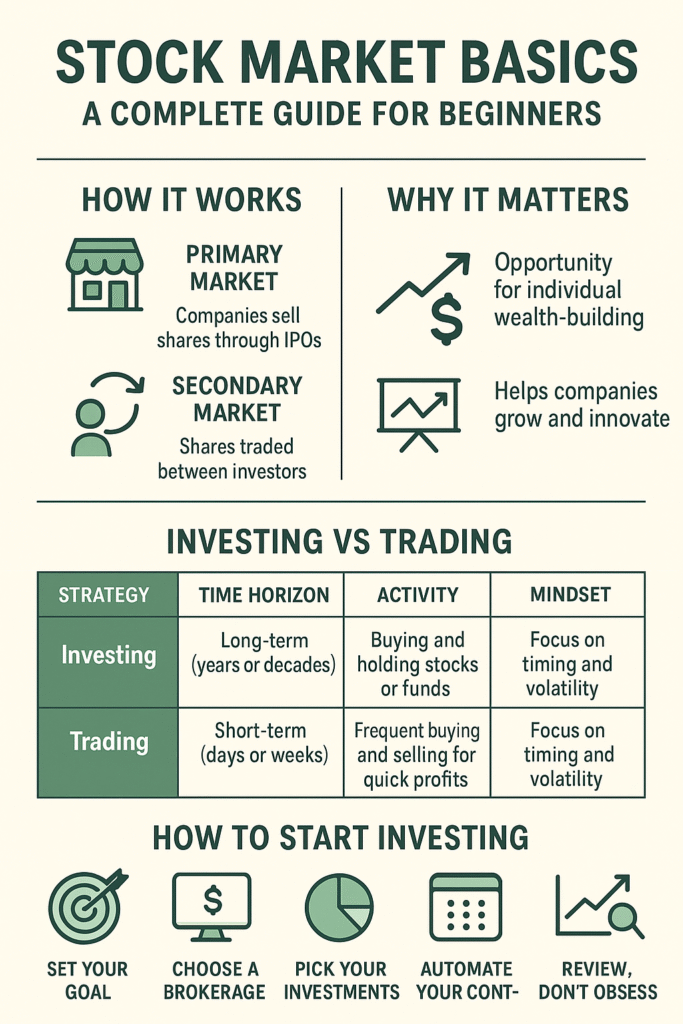

At its core, the stock market is a place where companies and investors meet. Companies issue shares, which represent partial ownership of their business. Investors buy those shares, hoping the value will rise over time as the company grows and becomes more profitable.

When a company first offers shares to the public, it’s called an Initial Public Offering (IPO). That initial sale happens on what’s known as the primary market. After that, the shares are bought and sold between investors in the secondary market, which is what we usually refer to as “the stock market.” (Investopedia)

Trading happens on organized exchanges such as the New York Stock Exchange (NYSE) and Nasdaq, which act like online marketplaces where buyers and sellers agree on prices. Indices such as the S&P 500 or the Dow Jones Industrial Average track groups of companies to show how the market is performing overall.

Why It Matters

The stock market isn’t just a playground for the wealthy or Wall Street professionals. It’s one of the most powerful tools for building personal wealth over time. It allows companies to raise money to innovate and expand while giving individuals the opportunity to share in that growth.

When you invest in stocks, you’re essentially becoming a part-owner of businesses like Apple, Amazon, or Coca-Cola. As those companies grow and earn profits, you benefit through rising stock prices and sometimes dividends. The stock market also serves as a mirror of the economy, reflecting public confidence, innovation, and growth across industries.

Investing vs Trading: Knowing the Difference

Before jumping in, it’s important to understand whether you want to invest or trade. They might sound similar, but the mindset and goals are very different.

| Strategy | Time Horizon | Activity | Mindset |

|---|---|---|---|

| Investing | Long-term (years or decades) | Buying and holding stocks or funds | Focused on growth and compounding returns |

| Trading | Short-term (days or weeks) | Frequent buying and selling for quick profits | Focused on timing and volatility |

For most beginners, investing is the smarter route. Trading can be exciting, but it’s high-risk and often emotionally draining. Investors like Warren Buffett built wealth not by flipping stocks but by owning great companies for years and letting compound interest do the heavy lifting.

Before buying your first stock, ask yourself: How long can I let this money grow? If your answer is “many years,” you’re thinking like an investor.

Key Insights Every Beginner Should Know

1. Know What You’re Buying

When you buy a stock, you’re not just buying a ticker symbol. You’re buying a slice of a real business. Learn what that company does, how it makes money, and whether it has an edge over competitors. If you can’t explain why the company exists and what gives it value, it might be safer to start with an index fund or ETF. (Schwab)

2. Diversification Is Your Safety Net

Putting all your money into one company is like betting your entire paycheck on a single horse. Instead, spread your investments across multiple companies or sectors. This strategy, called diversification, helps protect you when one stock underperforms. Many beginners start with an index fund that automatically gives exposure to hundreds of companies. (The Motley Fool)

3. Pay Attention to Costs

Even small fees can quietly reduce your returns. Choose a broker that offers low or zero commissions, and look for funds with low expense ratios. Over time, minimizing costs can have a huge impact on how your portfolio grows.

4. Don’t Try to Time the Market

The biggest mistake new investors make is trying to buy when prices are low and sell when they’re high. The truth is, nobody knows exactly when that will happen. The better strategy is dollar-cost averaging — investing a fixed amount regularly, whether prices are up or down. This smooths out the cost of your investments over time.

5. Focus on Learning, Not Just Earning

When I first started investing, I treated my early investments as tuition for learning how markets work. I read company reports, followed economic trends, and watched how my emotions reacted to market swings. Over time, the experience became more valuable than the short-term profits. Treat your first few months as a learning period rather than a race to make money.

How to Start Investing in the Stock Market

Step 1: Set Your Goal

Start by defining why you’re investing. Is it for retirement, buying a home, or simply to grow wealth over time? Your goal will shape your strategy, time horizon, and the amount of risk you’re willing to take.

Step 2: Choose a Brokerage Account

Select a reliable brokerage platform that suits your needs. Look for features such as fractional shares, zero commissions, and educational tools. Companies like Fidelity, Charles Schwab, and Robinhood make it easier than ever to start investing even with small amounts.

Step 3: Pick Your Investments

You can start with one of the following approaches:

- Index Funds or ETFs: Ideal for beginners who want instant diversification.

- Individual Stocks: Choose companies you understand and believe in for the long term.

- Robo-Advisors: Automated platforms that build and manage a portfolio for you.

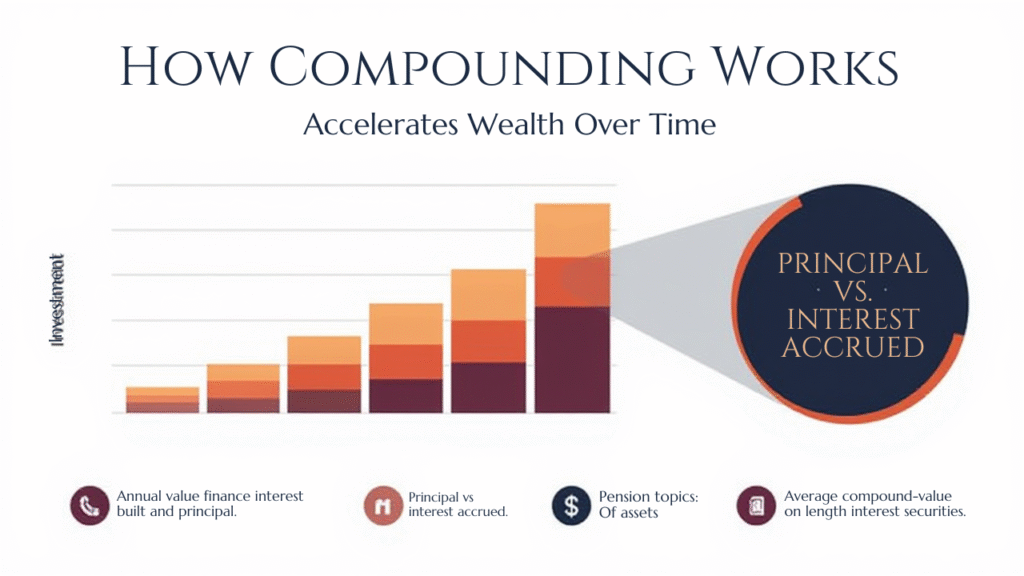

Step 4: Automate Your Contributions

Set up automatic deposits into your investment account each month. Even $25 or $50 a month can grow significantly over time thanks to compounding. Automation also helps you stay consistent and avoid emotional decisions.

Step 5: Review, Don’t Obsess

It’s tempting to check your portfolio every day, but that’s not productive. The stock market fluctuates daily, and short-term movements don’t matter much in the big picture. Review your portfolio quarterly or semiannually to ensure it still aligns with your goals.

My First Year in the Stock Market

When I began investing, I made my fair share of mistakes. I bought a few trendy stocks without researching them properly, and one quickly dropped in value. But instead of panicking, I decided to treat it as a lesson. I learned how to read financial statements, follow market trends, and understand the importance of patience.

I discovered that investing isn’t about guessing what will happen next week. It’s about trusting that over the long term, quality businesses grow, and so will your investments. The experience also taught me how to manage emotions — not letting fear or greed drive decisions.

If you can stay calm when your portfolio dips temporarily, you’re already ahead of most investors.

Common Mistakes to Avoid

- Jumping into stocks because they’re trending on social media.

- Investing money you might need soon for emergencies or bills.

- Ignoring fees and commissions that can eat into returns.

- Trying to get rich quick by timing the market.

- Failing to diversify across sectors and regions.

- Checking your portfolio too often and reacting emotionally.

Final Thoughts

The stock market is not a casino or a guessing game. It’s a platform that allows you to become a co-owner of real businesses that power the global economy. Success doesn’t come from luck or timing. It comes from consistency, patience, and a willingness to keep learning.

Even if you start small — $100, $500, or $1,000 — the key is to start. Open your account, set your first goal, and make your first investment. Every great investor began with that one first step.

So take yours today. You’ll thank yourself in five, ten, or twenty years when your money has quietly been working for you all along.

Call-to-Action:

If you found this beginner’s guide helpful, share it with a friend who’s curious about investing. And if you’d like more easy-to-understand guides on the stock market, personal finance, and building wealth, subscribe to our newsletter or explore our related articles. Your financial journey starts here.