Introduction

When you follow the stock market inflation impact, every new inflation report can feel like the market’s heartbeat — rising or falling with each data release. The latest 2025 CPI numbers stirred that heartbeat again, sending ripples across global markets. In this post we unpack the most recent inflation data, explore how markets are reacting, and offer a fresh perspective on what this could mean for investors going into 2026.

What’s the latest on inflation and CPI

Recent CPI trends

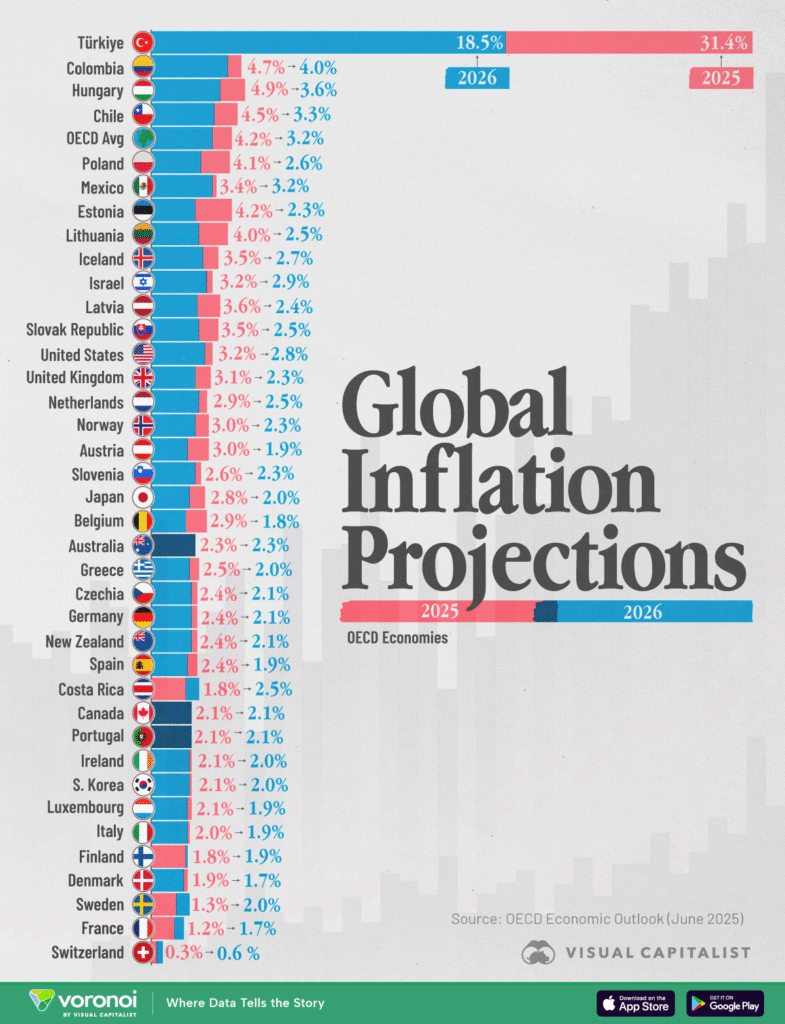

This year inflation has remained a tricky story. According to recent reports, headline inflation across many advanced economies remains elevated. For instance, the Organisation for Economic Co‑operation and Development (OECD) reported that headline inflation held broadly stable at 4.2 percent in September 2025. OECD

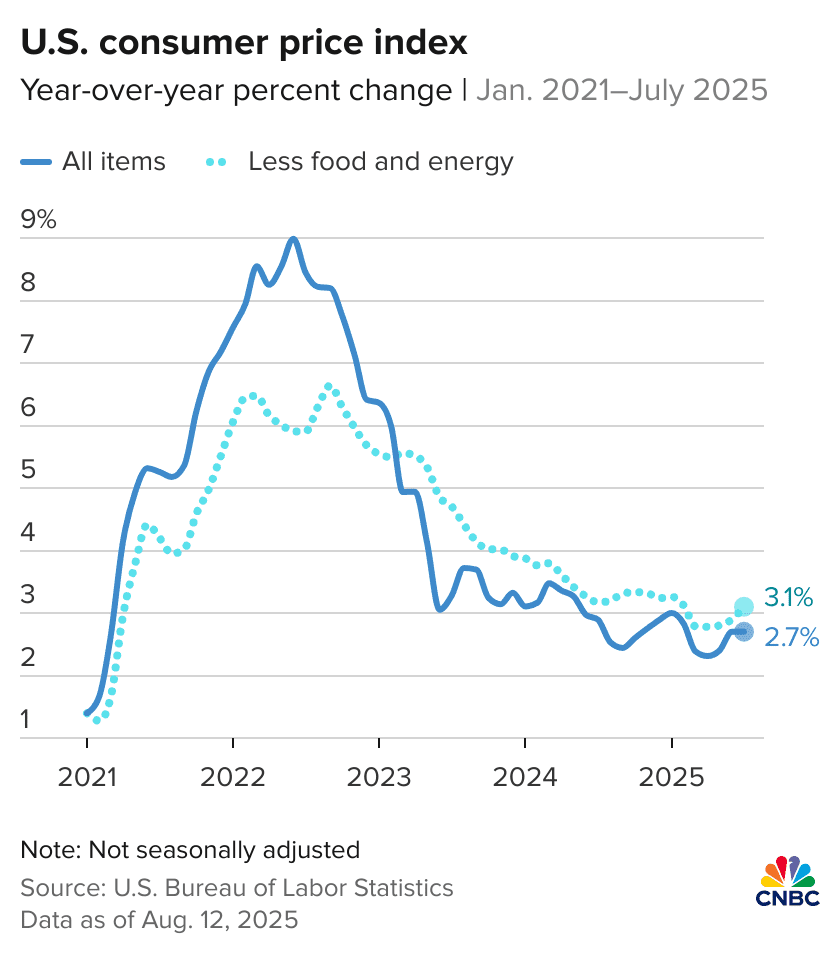

In the U.S., the most recent monthly CPI release showed somewhat muted inflation compared with sky-high rates of prior years. That softer reading helped spark a relief rally in equities. CBS News+2Nasdaq+2

But inflation remains “sticky.” Core CPI — which excludes food and energy, and is often seen as a better gauge of underlying inflationary pressures — continues to hover above the comfort zone for many central banks. FinancialContent+2Investing.com+2

Why this matters

Why do investors care so much about CPI numbers? Because CPI influences central-bank policy decisions (especially interest rates), which in turn affect valuations across the stock market. When CPI comes in lower or softer than expected, there’s optimism that central banks might cut or pause rate hikes, which tends to boost growth-oriented stocks. Conversely, “hot” inflation readings can spook markets — as higher interest rates tend to hammer valuations, especially for interest-rate–sensitive sectors like tech. IG+2Nasdaq+2

How the Stock Market Is Reacting

Let’s look at how recent inflation data has influenced equity markets and investor sentiment.

Positive CPI surprises → rallies

- On a recent CPI report, U.S. equities rallied strongly: the S&P 500 rose more than 1%, and major indexes moved toward record highs as investors welcomed the possibility of the Federal Reserve being able to ease monetary policy. CBS News+1

- Historically, when CPI prints come in a bit cooler than expected (or show moderation), markets often respond with relief rallies — especially if core inflation also stabilizes. Nasdaq+1

Elevated inflation or data delays → volatility and caution

- When inflation stays elevated, it keeps pressure on central banks, leading to uncertainty in interest rate policy. That can spook investors and increase volatility. FinancialContent+1

- Recently, delays in CPI reporting (because of data disruptions) have created uncertainty. For example, markets reacted when a CPI release was postponed — trading on “expectations and vibes” rather than hard data. Equiti Default

Sectoral impacts

Different sectors respond in different ways depending on inflation and interest-rate expectations:

- Growth/Tech stocks tend to benefit when inflation moderates, because lower interest rates boost their discounted future earnings.

- Value stocks, financials and dividend-yielding companies may perform relatively better in stable-but-high-inflation periods, especially if investors seek stable income as bond yields rise or stay high.

- Consumer-sensitive sectors (retail, discretionary) can get squeezed if inflation erodes purchasing power or leads to higher input costs.

Key Insights & What I’m Paying Attention To

Here are some of the most important takeaways — and some personal observations on how this plays out in real investor behavior.

🔎 Insight 1: “Softish” CPI can still generate optimism, but inflation remains too sticky for comfort

The fact that recent CPI reports came in cooler than expected gave markets a boost. But core inflation remains elevated well above many central-bank targets. That means even small positive surprises won’t end investor wariness — the “inflation overhang” remains.

From personal experience following markets, I’ve seen how even modest dips in CPI can trigger a sense of relief among traders — but that optimism can quickly fade if subsequent data shows stickiness (especially in shelter, wages, or energy).

🔎 Insight 2: Uncertainty (data delays, mixed signals) may cause more volatility than clear “good” or “bad” CPI

When data releases get delayed or mixed (headline CPI down but core up, or inflation low but producer-price or wholesale inflation rising), markets tend to “whipsaw.” The recent postponement of a CPI release raised speculation, pushed rate-cut probabilities around, and sent equities up as investors placed bets on easier monetary policy. Equiti Default+1

That environment rewards nimble traders and punishes those with rigid long-term positions. It also increases the value of diversification and hedging.

🔎 Insight 3: CPI results are a leading barometer — but not the whole picture

Focusing solely on headline CPI can be misleading. Core CPI, producer-price data, wage growth, consumer sentiment, retail sales and other metrics often provide the “full context.”

For example, even with softer CPI, rising producer prices (especially in energy and wholesale goods) or weak retail sales can undermine confidence. Recent PPI data showed a rise in energy and goods prices, which could eventually filter through to consumers. Reuters+1

As an investor, I’ve found that paying attention only to CPI — without watching commodity prices, credit conditions, and consumer demand — can lead to surprises.

🔎 Insight 4: Inflation sensitivity could shape portfolio strategies for 2026

Given how inflation remains a wild card, portfolio construction needs to adapt. For many investors this might mean:

- Allocating to companies with strong pricing power or essential-services offerings (consumer staples, utilities, healthcare)

- Balancing growth and value exposure — since rate expectations will swing sentiment

- Hedging with assets less correlated to equities (commodities, real assets, inflation-protected securities)

- Keeping an eye on earnings growth rather than just macro expectations — companies that grow earnings even under cost pressure may hold up better

Comparison: Recent Inflation Episodes vs Today

Here’s a quick table comparing recent CPI/inflation periods and how markets responded — and how the current situation stacks up.

| Period / Episode | Inflation Trend | Market Reaction | Lessons / Observations |

|---|---|---|---|

| Early 2022 — Post-pandemic surge | CPI peaked ~9%+ | Sharp volatility, steep rate hikes | Inflation shock, central-bank tightening |

| Early 2025 — Inflation cooling down | CPI ~2.4%–3.0%, core moderate | Equities rebound; rate-cut hopes | “Soft landing” narrative, but cautious optimism CBS News+1 |

| Late 2025 — Recent CPI/Fed uncertainty | CPI still ~3%, still sticky core inflation | Mixed sentiment, volatility on data and news | Inflation remains uncertain; markets reactive to each data release FinancialContent+1 |

The current environment is closer to the early 2025 period — not explosive inflation, but not “safe landing” either. It feels like walking on a tightrope: one rude data surprise could shift markets significantly.

What This Means for You (Especially if You’re an Investor)

📈 For long-term investors

- Stay diversified: Given inflation’s unpredictability, a mix of sectors and asset classes can help smooth returns.

- Focus on fundamentals: Companies with strong balance sheets, pricing power, and predictable cash flows may outperform in uncertain times.

- Don’t chase hype: Avoid making portfolio changes based solely on weekly CPI or news headlines — use inflation as one factor among many.

🔄 For traders and short-term investors

- Be ready for volatility: CPI releases, central-bank comments, and data delays can trigger swings. Flexibility matters more than conviction.

- Use tools to hedge: Consider inflation-linked assets, treasuries, or diversified ETFs to protect downside during whipsaw periods.

- Monitor other data — PPI, wages, consumer-sentiment, retail sales — to anticipate possible inflation/market divergence.

🌍 For global-minded investors

Remember that U.S. CPI isn’t the only story. Inflation in other regions — including energy, food, and transportation costs — matters for global supply chains, commodities, and currency markets. The global CPI backdrop remains patchy. OECD+1

Conclusion

Inflation remains a defining macro theme for the stock market in 2025. Recent CPI data offered a bit of a breather, giving equities a lift — but underlying pressures remain. Core inflation, input cost pressures, and lingering global macro risks suggest that we are far from a stable “soft-landing.”

From my perspective, the key lesson is this: treat CPI data as one of several important signals — not a silver bullet. Markets will continue to react sharply, but well-prepared investors who focus on fundamentals, diversify, and remain adaptive stand a much better chance of navigating the cycle.

If you found this analysis useful, share your thoughts in the comments below. Are you positioning for inflation to fall — or bracing for more turbulence? And would you like me to share sector-by-sector investment ideas based on this CPI environment (e.g., what looks safe, what looks risky)?